Buying A Pharmacy Building For Your Gym??

Vacant Walgreens, CVS and RiteAids might be the most practical building purchases for gym owners.

Not all brick-and-mortar businesses are surviving, but that’s good news for gym owners.

During the Pandy in 2020 and 2021, gym owners were led to believe that their physical buildings would be a thing of the past. The rise of at-home fitness solutions combined with the forced government closures of gyms made the argument seem potentially accurate.

However, as we all know, the brick-and-mortar gym scene is doing better than ever, but that’s not necessarily true for other sectors - especially pharmacies.

Yes, your local CVS, Walgreens, and RiteAid may have likely either been closed or are on the chopping block as we speak.

Extensive lawsuits from the opioid crisis, giant investments in online pharmacies, soaring rates of shoplifting, and the delivery-to-your-doorstep app culture have rendered the current pharmacy model almost obsolete.

Last month, RiteAid filed for Chapter 11 bankruptcy and announced the immediate closure of 400 - 500 locations.

In 2022, CVS announced it would close over 900 stores.

Walgreens, even pre-Pandy, started the consolidation of 200+ stores in 2019 and has increased pace ever since.

Due to these events, there are hundreds of former pharmacy buildings available for lease and purchase throughout the US.

So how is this good news for gym owners looking to ultimately own their commercial real estate (CRE)? Allow me to break it down.

What makes former pharmacy buildings an interesting CRE acquisition for a gym owner?

While each brand has its own needs and wants when it comes to CRE, there are common denominators that would suit the majority of microgyms. Pharmacy buildings check most of those boxes, while also presenting some unique challenges.

Standalone buildings | Almost all major pharmacy brands built standalone units on prominent corner locations. The standalone building is ideal because you don’t share walls with any neighbors. This building type allows the decibels and vibrations coming from your workout floor to happen without the threat of eviction due to disturbing other tenants.

Private parking lot | These buildings also come with ample, private parking. The average parking lot in this particular building class has 50+ spaces. Having your own dedicated parking lot to accommodate the simultaneous inflow and outflow of your members is extremely hard to come by, but if you can find it, it creates a far better client experience versus street parking or paying at a meter.

Prime locations | The location strategy for CVS, Walgreens, and RiteAid is one that any gym business could benefit from - commonly found on high-traffic corners and across the spectrum of urban, suburban, and rural markets. Approximately 82% of Americans live within 10 miles of a CVS Pharmacy and over 75% live within 5 miles of both a CVS and a Walgreens store.

Retail exterior with industrial guts | From the exterior, these are modern buildings with enough storefront glass at the entrance to provide visibility and natural light, but not completely encased in large, retail windows that chew up precious wall space. However, the interiors of these buildings present much more like a modern warehouse. High, exposed ceilings (minus older RiteAids that still use a drop ceiling), multiple bathrooms located in the rear of the store, and full HVAC throughout.

Large footprints may require creative subletting | Yes, these sites are big, ranging from 8,000 - 14,000 SF. This is likely an ideal size for an open gym model (think modern globo-gym), or a CrossFit affiliate with a large membership base. However, for the smaller, boutique microgym owners - you would have to be willing to create subdivisions and sublease out the additional space, which if you could fund it and find the right tenants, could be extremely attractive.

Drive-thru??? | Then there’s that. Some of these sites have covered drive-thrus that create an interesting problem or an opportunity. To date, in our conversation with clients who have an interest in these buildings, we’ve heard suggestions that range from “just keep it for nostalgia” to turning the covered pad into an outdoor workout area.

Making the numbers work.

While writing on this topic is timely and relative considering RiteAid's recent bankruptcy, I’ve also been consulting with more than one group through The Gym Real Estate Company who see the same opportunity I do.

Here’s a hypothetical case study that would present a favorable business scenario for a gym owner to purchase one of these sites:

This is an active (at the time of writing this at least) listing for a former Walgreens in Georgia listed for $1,000,000.

The gym owner was smart, hired The Gym Real Estate Company and we were able to negotiate a reduced sales price of $875,000.

After working with the GC, architect, and engineers - we have interior fixtures, equipment, flooring, and improvement construction cost of $400,000. This brings the total cost of the project to $1,275,000.

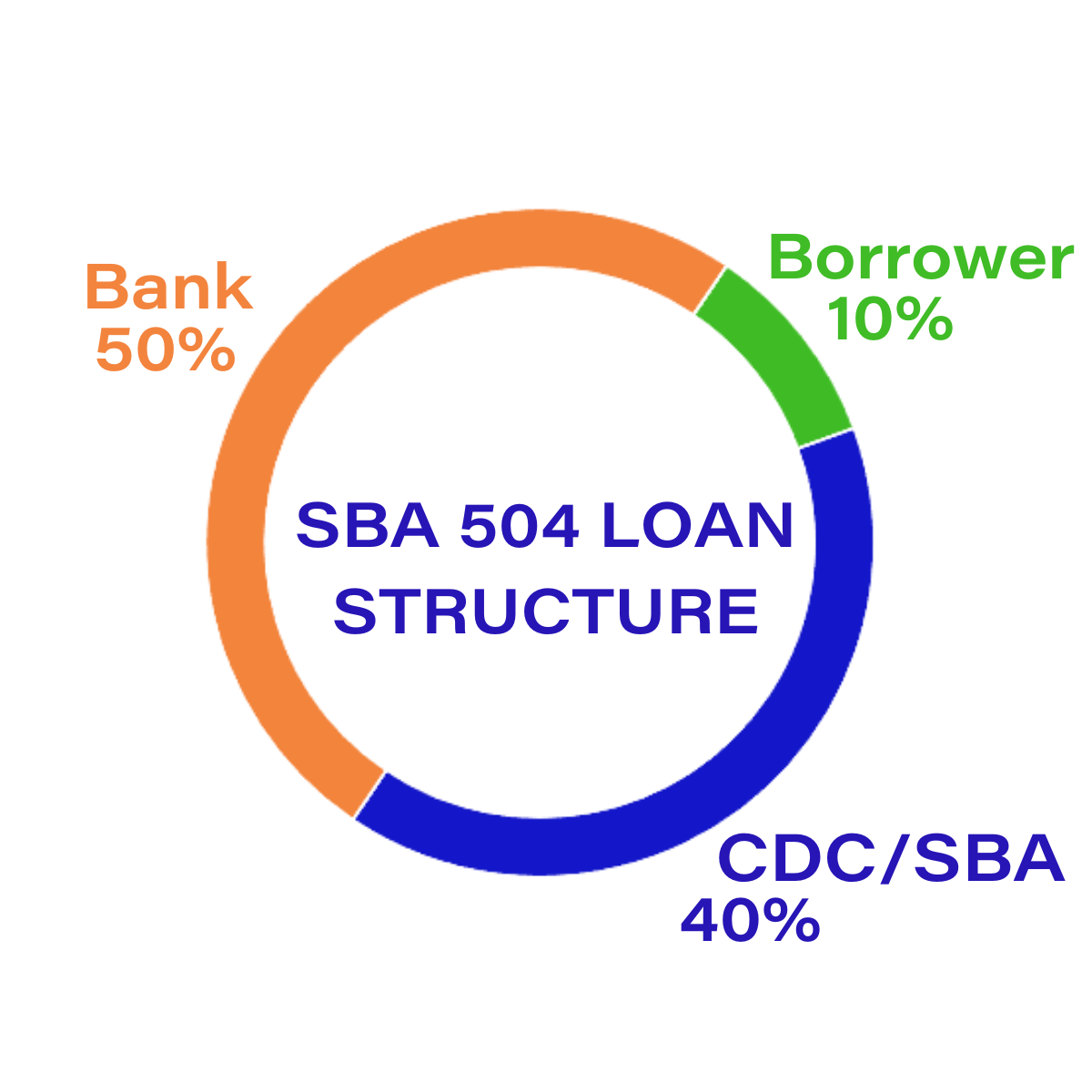

Through our preferred SBA lenders, the client was approved for an SBA 504 loan in which a bank contributed $637,500 (50%), the CDC/SBA contributed $510,000 (40%), and the gym owner contributed $127,500 (10%) as the down payment.

This loan is locked in at 7.5% for 25 years, resulting in a monthly payment of $8,479.20/mo.

The business plan for this gym (yeah, that’s included in our services too) projects annual revenue at early maturity to be $480,000/yr ($40,000/mo). Due to the nature of their business model (hybrid open gym + limited group classes), we estimate a modest 22% profit margin.

Our later projections show this business hitting $660,000/yr ($55,000/mo), with the opportunity to grow.

For gym owners who do not own their real estate, we don’t advise spending more than 25% of your TMR (total monthly revenue) on your rent. However, once you own the building, we can increase that amount.

In this case, we’ve advised the client to charge themselves $11,000/mo in rent*. *NNN fees not included in this estimate

At a high level, their gym business will profit ~$105,600/yr in the early stages, plus an NOI (net operating income) for their CRE holdings company of $30,241/yr.

If pharmacy buildings don’t work for your needs, can I interest you in a vault?

Speaking of old-use buildings that are going by the wayside, when was the last time you walked into a bank?

While many brands like Chase and TD are reimagining their brick-and-mortar stores for the future, there are many banking locations across the country being sold or auctioned off.

While the typical reuse of this type of building would be fast food/casual restaurants, they do present some interesting opportunities for gym owners who want to own but need a smaller footprint compared to the pharmacy strategy.

Averaging ~3,500 SF, with dedicated parking, a standalone building structure, and dirt-cheap sales prices, it may intrigue some owners.

However, we will say that the upfit costs on these buildings can get intense. Do you have any idea how expensive it is to remove a vault? Maybe we just keep it in and build the brand around it.

If you’re a gym owner looking to lease or buy a building anywhere in the United States, I’d love to set up a Discovery Call with you to learn more about your project and show you how The Gym Real Estate Company can help that dream become a reality.